SoftBank announces $3.4bn share buyback

SoftBank has announced a $3.4 billion share buyback after the stock fell sharply amid a sell-off in Japanese and technology stocks.

The Japanese technology investor’s shares have fallen by almost a third in the past month as fears mount over the high valuations attributed to companies investing in artificial intelligence.

The slump left Softbank with a market capitalisation of $73.1 billion, far lower than the company’s estimated $170 billion net asset value. The discrepancy meant the company’s shares were trading at a discount of around 60 per cent to the value of its holdings.

On Wednesday the company unveiled a plan to buy back up to 6.8 per cent of shares over the next 12 months. The announcement came after calls for a share buyback from Elliott Management, the aggressive activist investor, which is reported to have rebuilt a position in SoftBank worth more than $2 billion.

Yoshimitsu Goto, Softbank’s chief financial officer, said: “It’s certainly possible that we may decide on another share buyback programme at some point in the future. Shareholder return is always a main theme of discussion among the board of directors.”

He insisted that external pressure did not play a part in the buyback, adding: “SoftBank is not the kind of company to make decisions based on the influence of an individual party.”

SoftBank is rebuilding its finances after investments in loss-making companies, including a huge bet on WeWork that turned sour when the office landlord filed for bankruptcy.

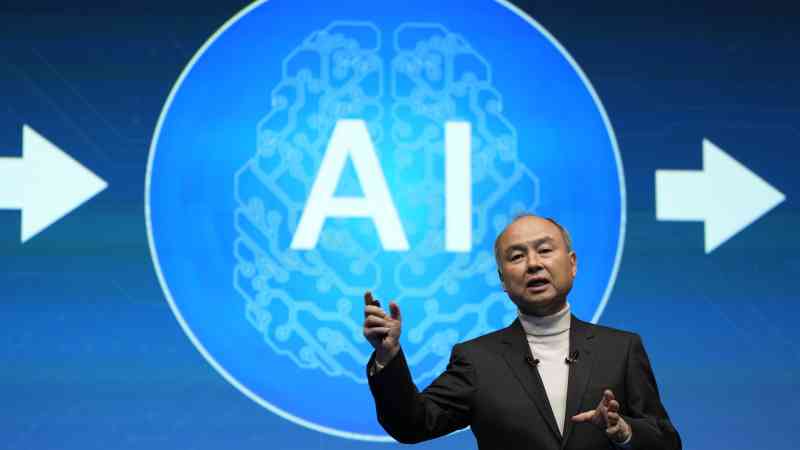

It is now betting on the transformative role of artificial intelligence technology, with major stakes in businesses including Arm Holdings, the Cambridge-headquartered chip designer.

News of the buyback accompanied results that saw SoftBank report a surprise net loss for the three months to the end of June.

The first-quarter loss of 174.3 billion yen ($1.18 billion) was roughly a third of the loss logged in the same period a year earlier, but was far worse than consensus estimates for a profit of 104.7 billion yen. The figures are based on reported net income attributable to shareholders and reflected a hit from higher taxes.

On a separate measure, net income, it swung to a modest profit of 10.5 billion yen for the period.

Its Vision Fund investment unit booked an investment gain of 1.9 billion yen after an investment loss of 58 billion yen in the previous quarter.

Goto said SoftBank is investing with the advent of what it called an age of artificial superintelligence in mind.

Recent acquisitions include Graphcore, a British artificial intelligence chipmaker, for an undisclosed sum. “The evaluation of new technology undergoes cycles of hype and correction, ultimately being assessed based on its actual performance,” the company said.

SoftBank highlighted how generative AI is being used across its portfolio. It cited Klarna, the buy now pay later company, using an AI assistant to handle customer queries, and ByteDance, the Chinese owner of TikTok, which has launched its own AI chatbot in China.

SoftBank’s shares climbed $2.45, or 9.9 per cent, to $27.16 on Wednesday morning in New York.

Post Comment