Is the fall in Big Tech stocks merely a blip?

For months it seemed as though nothing could stop the artificial intelligence-driven technology bull run on Wall Street. Then Donald Trump changed the story.

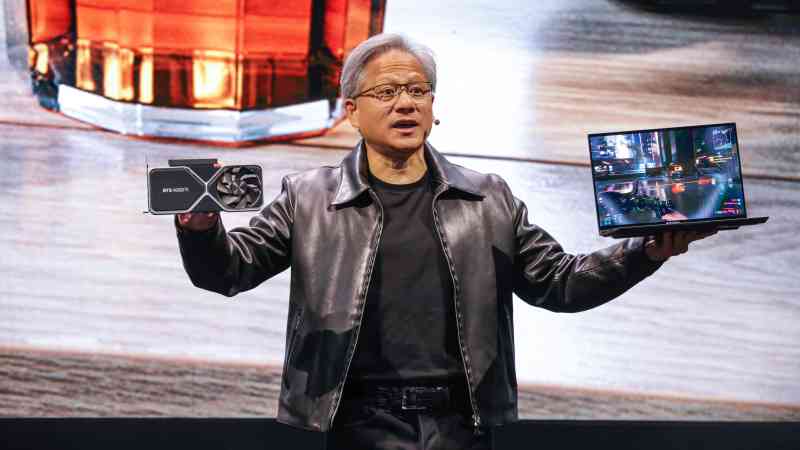

The Nasdaq Composite had its worst day in nearly two years on Wednesday as investors rotated out of Big Tech. More than $200 billion of market value was wiped off the value of Nvidia, the chip manufacturer, alone. The S&P 500 similarly retreated and, along with the Nasdaq, suffered further losses on Thursday.

Trump, the Republican presidential nominee, rattled markets after a Bloomberg interview was published on Tuesday night in which he appeared to be dismissive of America’s interest in defending Taiwan, where the majority of the world’s supply of microchips is produced. The supply chain of almost every big technology company has interests in the island nation, which is under military threat from China.

Trump’s remarks came as investors were already feeling nervous about whether stock valuations of some of the world’s biggest companies were starting to look stretched. The so-called Magnificent Seven, made up of Alphabet (the owner of Google), Amazon, Apple, Microsoft, Meta Platforms, Nvidia and Tesla, account for about a third of the S&P’s entire value after their share prices surged this year, driven ever higher by the market and corporate optimism surrounding AI.

Investors were already starting to shift away from heavyweight stocks into companies with smaller valuations as the prospect of the US Federal Reserve cutting interest rates in September encouraged a search for value in the broader market. Smaller-cap stocks typically are more exposed to borrowing costs than the cash-rich, big technology companies and so stand to benefit from a change in monetary policy.

Dan Ives, a New York-based analyst at Wedbush Securities and a longstanding technology bull, is unfazed, though. “We just believe the bark [of Trump] is worse than the bite,” he said. “It’s a game of high-stakes poker in a political campaign. And the AI party, it’s 9pm [and] that goes to 4am. We don’t think that Trump, if he wins, turns the music off at the party.”

Ives compared 2024 with 1995, at the start of the dotcom boom, when the internet drove rapid rises in company valuations before the bubble burst spectacularly in the early 2000s. “I believe it’s a 1995 moment,” he said. “I think numbers go much higher. And the AI revolution, it’s only the early days of this all playing out.”

Analysts are predicting strong second-quarter earnings next week for Alphabet, followed by Microsoft, Meta and Apple the following week, which could support stock market valuations.

Alphabet’s stock has risen by 28 per cent in the year to date amid optimism about the AI capabilities linked with its Search and YouTube businesses, as well as AI-driven demand for its cloud infrastructure services.

Microsoft, seen to be leading the AI revolution after forming a partnership with OpenAI back in 2019 and integrating the latter’s technology into its products, had risen by 19 per cent this year before it took a hit to its value today amid the global technology crisis that affected its systems.

Meanwhile, shares in Meta, the owner of Facebook, have risen 37 per cent this year. It, too, is investing heavily in AI research and product development.

So far, so good, but not everybody is buying into the story that such growth can continue. Citigroup’s analysts recently advised investors to start taking profits from “AI high-flyers” and to “re-balance toward a broader array of AI stocks across the value chain”.

Moreover, valuation rises have been concentrated in only a small number of interconnected companies, which amplifies the investment risk, some analysts have warned. Nvidia performs well because Microsoft, Google and Meta are buying its chips.

Stuart Kaiser, Citi’s head of equity trading strategy, said the market reaction to results next week was difficult to predict because expectations had been driven so high. “Our guess is they’ll put up, at minimum, solid results and potentially stronger results,” he said. “The question will be, in this environment, with tech stocks under pressure, is ‘good’ good enough or do you need to be better?”

He added that while Citi agreed with the transformative potential of AI, it had been “very, very hard to pick winners and losers”. Of its AI basket of 36 stocks, only 14 are up in the year to date. Volatility among smaller shares in the sector has encouraged investors to crowd around the biggest players, such as Nvidia, Microsoft and Apple, which have strong stories around how AI can drive the growth of their businesses.

“If I told you, ‘I’ve got this software stock and they’re going to be a winner in AI and they’re spending X billions of dollars over the next three to four quarters to build that capability,’ you really are taking a leap of faith that they’re going to invest that money correctly, and then some time four, eight or twelve quarters later you’re going to see the revenue or the cost savings,” Kaiser said.

“I think that’s why people are playing it close to home and are saying, ‘If you’re a stock that can prove to me you can generate [revenue] or a cost saving visibly now, I’m in.’ Otherwise, these stocks really need to be very convincing in terms of what they’re doing.”

Scepticism around the transformative potential of AI on companies’ costs and revenue is growing on Wall Street. Jim Covello, head of global equity research at Goldman Sachs, argued this week that AI wasn’t built to address the complex problems it would need to solve in order to earn an adequate return on the $1 trillion estimated cost of developing and running AI technology.

“We’re a couple of years into this and there’s not a single thing that this is being used for that’s cost-effective at this point,” he told Goldman Sachs Exchanges, the investment bank’s podcast. “I think there’s an unbelievable misunderstanding of what the technology can do today. The problems that it can solve aren’t big problems. There is no cognitive reasoning in this.”

Daryl Jones, director of research at Hedgeye Risk Management, a Connecticut-based investment research company, believes the technology bull run would continue. He sees the biggest market risk in the longer term as inflation accelerating again after predicted rate cuts later in 2024.

“In the short run, these interest rate cuts should continue to be good for the market generally, maybe even continue to build the small-cap rally,” he said. “But as we roll through into the end of the year and then next year, the bigger risk looming, I think, is inflation re-accelerates and we look back at these rate cuts and realise that maybe [it was] too soon.”

Analysts are doubtful whether Trump’s latest comments would reflect future policy should he win the election in November, but there are plenty of other reasons to expect more volatility around technology stocks for the rest of the year.

Post Comment